Does Applying To Credit Cards Hurt Credit

Opening a new credit card can temporarily ding your credit score.

When a card issuer looks at your credit information because you've applied for a credit card, it is a so-called " hard pull. " That can lead to a slight drop in your credit score, whether you are approved or not.

Get score change notifications

See your free score anytime, get notified when it changes, and build it with personalized insights.

Other ways opening a new credit card can hurt your credit

Simply applying for a new card can cause your score to slip a bit, but a new card can result in a bigger drop if you use a lot of that new line of credit. Or if you have only one or two other cards, and they are only a few years old.

Here's how opening a new card might hurt your credit:

Higher balances. A new credit card might hurt your score if make a big purchase or you get a balance-transfer card and transfer your higher-interest debt to the card so that you have high credit utilization . The amount of your credit limit that you use is weighted heavily. Credit utilization is calculated both per-card and overall.

Experts recommend going no higher than 30% on any card, and lower is better.

However, it's smart to look at overall finances, not just your credit score. Accepting a drop in your score due to high credit utilization because you got a 0% balance transfer card deal to pay off debt may be worth it.

Lower average age of accounts. How long you've had credit also affects your score. Your new card can reduce the average age of your credit. If you have few credit cards, it will have a bigger impact than if you have many.

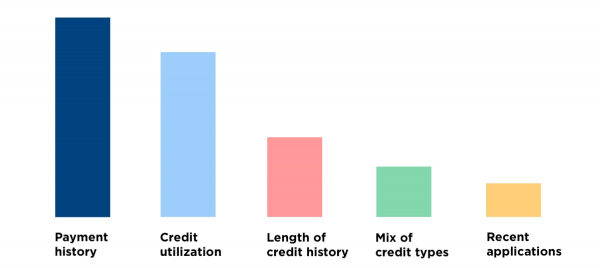

Length of credit history, however, is a relatively minor factor in credit scores. It counts as 15% of your FICO score. VantageScore, another credit score provider, lists "age and type of credit" as "highly influential."

Opening a new card also has benefits

A new line of credit can also help your credit profile.

A better track record. Paying on time, every time is essential for good credit. FICO , the credit score used most for credit decisions, says payment history accounts for 35% of credit score. Competitor VantageScore calls it "extremely influential."

If you're trying to build credit, nothing is more important than consistent, on-time payments. A new account gives you another opportunity to build up a record of on-time payments.

More room on credit cards. A new card will increase your overall credit limit. If your spending stays the same, your overall credit utilization will be lower, and that could help your score.

Credit diversity. Credit scores award points for showing you can manage more than one type of credit . If you have an installment loan but do not have a credit card, successfully managing your new credit card is likely to help. But if you already have several credit cards, adding one more is not as likely to have much of an impact.

Does Applying To Credit Cards Hurt Credit

Source: https://www.nerdwallet.com/article/finance/will-new-credit-card-hurt-credit-score

Posted by: danielsmundint.blogspot.com

0 Response to "Does Applying To Credit Cards Hurt Credit"

Post a Comment